Introduction

Welcome to the CardPay API. You use our APIs to receive payments and check payment status.

For recent changes please see the changelog.

Environments

There are two environments available for integration:

- Sandbox environment: https://sandbox.cardpay.com

- Production environment: https://cardpay.com

Sandbox Environment

Sandbox provides full functionality but it only emulates processing, no actual bank transactions are made. It supports the following card PANs:

| Card PAN | 3-D Secure result | Transaction result |

|---|---|---|

| 4000000000000002 | 3-D secure version 1, full authentication | Payment has CONFIRMED status |

| 5555555555554444 | 3-D secure version 1, full authentication | Payment has DECLINED status |

| 4000000000000044 | 3-D secure version 1, full authentication | Payment has AUTHORIZED status |

| 4000000000000036 | 3-D secure version 1, attempt | Payment has CONFIRMED status |

| 4000000000000093 | 3-D secure version 2, frictionless flow, success | Payment has CONFIRMED status |

| 4000000000000069 | 3-D secure version 2, frictionless flow, attempt | Payment has CONFIRMED status |

| 4000000000000085 | 3-D secure version 2, сhallenge flow, full authentication | Payment has CONFIRMED status |

| 4000000000000077 | No 3-D Secure | Payment has CONFIRMED status |

| 5555555555554477 | No 3-D Secure | Payment has DECLINED status |

| 4000000000000051 | No 3-D Secure | Payment has AUTHORIZED status |

If merchant receives non-financial error codes or technical error codes, he needs to contact Cardpay manager.

AUTHORIZED сards must be used to test antifraud system reaction with compulsory transfer payment to preauthorization.

You can use any cardholder name, expiry date and CVV2/CVC2 with these PANs. 3-D Secure is also emulated with a page that doesn’t require any password but only shows you 2 buttons. One button is for successful authentication, another is for failed authentication. Note, that when you chose to fail authentication, order is always declined, no matter what PAN was used.

To request any changes in settings of Sandbox environment you can directly contact our support via email or Skype.

Production Environment

Once you complete integration with Sandbox environment you will be provided with Production credentials. These are completely different Merchant and User accounts, not related with the ones on Sandbox.

Production always makes real bank transactions, cards from Sandbox are not supported on this environment.

To request any changes in settings of Production environment you need to contact CardPay manager.

API Entry Points

There are three merchant APIs:

- First one is the Payment API which provides complete server-to-server operations. It is used for sending new orders to the system. It provides a Payment Page Mode. When customer enters card detail on a form located on CardPay payment page or customer enters card details on merchant’s site (Gateway Mode).

- Second API is the Service API. It has additional methods to provide information about payments and to change payment status.

- Third one is REST API that is still in development and supports only limited number of operations but is intended to replace the first two.

All APIs are available via HTTP protocol using HTTP POST or HTTP GET methods.

Payment API Access Modes: Payment Page and Gateway

Depending on account settings Payment API can work in 2 different ways: as a Payment Page or as a Gateway.

3-D Secure version 2

3D Secure 2: a seamless integration to increase customer conversion rates and leverage your risk management.

Here’s the rundown on Cardpay’s new addition to Payment API and the Payment Page with additional customer information to get you started with 3-D Secure 2.

Due to 3-D Secure 2 rules and terms (see more information) Cardpay should collect additional customer information for 3-D Secure 2 verification.

Additional information can be collected by the merchant independently (on his side) and sent in the request (Payment Page and Gateway modes) or the customer should be enter all the necessary information on the additional page. This page will be displayed in cases when this information was not in the request from the merchant.

Additional information in POST request (create payment or recurring) should include the following fields:

<order trans_type="..."></order><order phone="..."></order><order work_phone="..."></order><order home_phone="..."></order><order ...><card acct_type="..." /></order><order ...><billing addr_line_1="..." /></order><order ...><billing addr_line_2="..." /></order>

Payment Page Mode

Overview

Payment Page Mode is used when Merchant chooses to use our payment page. Customer is redirected from merchant’s website to our payment page to enter card details. Customer data entered on our payment page is protected and managed by CardPay and certified to and complies with PCI DSS standard. All customer data is sent via secure connection.

CardPay API Endpoint

- Test URL:

https://sandbox.cardpay.com/MI/cardpayment.html - Live URL:

https://cardpay.com/MI/cardpayment.html

HTML Form

Example HTML Form

<?php

//html form template

$template = <<<EOT

<form method="post" action="%cardpay_url%">

<input type="hidden" name="orderXML" value="%cardpay_orderxml%">

<input type="hidden" name="sha512" value="%cardpay_sha512%">

<input type="image" width="170" height="30" src="//www.cardpay.com/images/logo.jpg" alt="Pay Now With CardPay!"/>

</form>

EOT;

<!DOCTYPE html>

<html>

<body>

<form action="https://cardpay.com/MI/cardpayment.html" method="POST">

<input type="hidden" name="orderXML" VALUE="PG9yZGVyIHdhbGxldF9pZD0iMjEiIG51bWJlcj0iNDU4MjEwIiBkZXNjcmlwdGlvbj0iQmVzdCBldmVyIHNlZW4gVC1TaGlydHMsIDExMDIxIiBjdXJyZW5jeT0iVVNEIiBhbW91bnQ9IjI5MS44NiIgZW1haWw9ImN1c3RvbWVyQGV4YW1wbGUuY29tIi8+"/>

<input type="hidden" name="sha512" VALUE="b258f153463c8787535a6e90836a4927b2ccddb5af64999ff4b530d74fff2a34959ff77d0b003004d0f9f6d923702c78b579187287809f820c8e77e0be5c9254"/>

<input type="image" width="170" height="30" src="https://www.cardpay.com/images/logo.jpg" alt="Pay Now With CardPay!"/>

</form>

</body>

</html>

To use API in this mode customer must be provided with HTML Form with filled hidden input fields. This Form is posted to the API URL by pressing “Pay” button.

There are only 2 parameters of request: orderXML and sha512.

orderXML- Base-64 encoded XML Requestsha512- see Calculating Digest section

XML Request

XML Request example using only the minimum required parameters

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="291.86" email="[email protected]"/>

Elements and attributes are case in-sensitive. Single quotes may be used instead of double quotes.

Elements in bold are mandatory. Attributes in bold are mandatory only if Element is present, default value is shown after equals sign.

Following data types are used:

String(XX)- any Unicode characters, some validation may be applied though. XX is supported length in Unicode characters, data is truncated if exceeded.Integer- only decimal digits.Decimal- decimal digits with dot as a decimal separator.Boolean- boolean flag: “true” / “false”.

Order Element Structure

| Element | Attribute | Type | Description |

|---|---|---|---|

| order | wallet_id | Integer | Unique merchant’s ID used by the CardPay payment system |

| number | String(50) | Order ID used by the merchant’s shopping cart | |

| description | String(200) | Description of product/service being sold | |

| currency | String(3) | ISO 4217 currency code | |

| amount | Decimal | The total order amount in selected currency with dot as a decimal separator, must be less than 100 millions | |

| String(256) | Customer’s e-mail address | ||

| customer_id | String(256) | Customer’s ID in the merchant’s system | |

| is_two_phase=false | Boolean | If set to “true”, the amount will not be captured but only blocked. | |

| recurring_begin=false | Boolean | If set to “true”, the payment can be repeated later using recurring_id from response. See section Recurring | |

| recurring_id | String(32) | Repeating payment sent before. See section Recurring | |

| generate_card_token=false | Boolean | If set to “true”, a Card Token will be generated and returned in the response or in the notification XMLs | |

| card_token | String(36) | Card Token used instead of card information | |

| authentication_request=false | Boolean | If set to “true”, amount must not be present in request, no payment will be made, only cardholder authentication will be performed. Also can be used to generate Card Token. | |

| locale=en | String(2) | Preferred locale for the payment page (ISO 639-1 language code). The default locale will be applied if the selected locale is not supported. Supported locales are: “en”, “ru”, “zh”, “ja” | |

| dynamic_descriptor | String(25) | Short description of the service or product, must be enabled by CardPay manager to be used | |

| trans_type | String(2) | Identifies the type of transaction being authenticated. Values accepted: 01 = Goods/Service Purchase, 03 = Check Acceptance, 10 = Account Funding, 11 = Quasi-Cash Transaction, 28 = Prepaid Activation and Load. Note: Values derived from the 8583 ISO Standard. | |

| phone | String(8-18) | Customer phone number. Recommended to send phone number in following format “+1 111111111” with country code and subscriber sections (only digits are accepted) of the number, “+” as prefix and “space” as delimiter. Refer to ITU-E.164 for additional information on format and length. | |

| work_phone | String(8-18) | The work phone number provided by the Cardholder. Required (if available) unless market or regional mandate restricts sending this information. Format: string (8-18 symbols) country code + Subscriber number. Refer to ITU-E.164 for additional information on format and length. Example: +1 111111111 | |

| home_phone | String(8-18) | The home phone number provided by the Cardholder. Required (if available) unless market or regional mandate restricts sending this information. Format: string (8-18 symbols) country code + Subscriber number. Refer to ITU-E.164 for additional information on format and length. Example: +1 111111111 | |

| note | String(100) | Note about the order that will not be displayed to customer | |

| return_url | String | Overrides default success URL, inprocess URL, decline URL and cancel URL. See section Return URLs. return_url can be used separately or together with other url parameters |

|

| success_url | String | Overrides default success URL only. See section Return URLs | |

| decline_url | String | Overrides default decline URL only. See section Return URLs | |

| cancel_url | String | Overrides default cancel URL only. See section Return URLs | |

| inprocess_url | String | Overrides default inprocess URL only. See section Return URLs | |

| order/shipping | shipping element | Represents an address where the order will be delivered to. See shipping element structure below | |

| order/items | List of item elements | List of order positions (items in the shopping cart). See item element structure below | |

| order/flights | List of flight elements | List of flights and passenger information for airlines. See flight element structure below |

Shipping Element Structure

Example of XML Request with Shipping element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<shipping country="USA" state="NY" zip="10001" city="New York" addr_line_1="450 W." addr_line_2="33 Street" phone="+1 111111111"/>

</order>

SHIPPING is the address where the order will be delivered. It is used in Anti-fraud System and also can be seen in Payment Manager. But it may be omitted and all the fields of it except country may be omitted too.

| Element | Attribute | Type | Description |

|---|---|---|---|

| shipping | country | String(3) | ISO 3166-1 code of delivery country: 2 or 3 latin letters or numeric code |

| state | String(20) | Delivery state or province. May include whitespaces, hyphens, apostrophes, commas and dots | |

| zip | String(12) | Delivery postal code | |

| city | String(20) | Delivery city. May include whitespaces, hyphens, apostrophes, commas and dots | |

| street | String(2-100) | (Deprecated. Replaced by addr_line_1, addr_line_2). Delivery street address. May include whitespaces, hyphens, apostrophes, commas, quotes, dots, slashes and semicolons | |

| phone | String(5-20) | Valid customer phone number. Example: +1 111111111 | |

| addr_line_1 | String(0-50) | First line of the street address or equivalent local portion of the Cardholder shipping address associated with the card used for this purchase. Can include street and house number | |

| addr_line_2 | String(0-50) | Second line of the street address or equivalent local portion of the Cardholder shipping address associated with the card used for this purchase. |

Item Element Structure

Example of XML Request with Items element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<items>

<item name="T-Shirt" description="Funniest print you ever saw" count="1" price="30"/>

<item name="T-Shirt" description="Coolest print you ever saw" count="4" price="60"/>

</items>

</order>

Item element represents individual order item or service.

| Element | Attribute | Type | Description |

|---|---|---|---|

| item | name | String(50) | The name of product / service, provided to the customer |

| description | String(200) | The description of product / service, provided to the customer | |

| count | Numeric | The count of product / service, provided to the customer. Any positive number | |

| price | Decimal | Price of product / service with dot as a decimal separator, must be less than 100 millions |

Flights Element Structure

Example of XML Request with Flights element:

<order wallet_id="21" number="458210" description="Flight from London to Barcelona with transfer in Rome" currency="USD" amount="270" email="[email protected]">

<flights passenger_name='JAMES BOND' departure_date='31.12.2018' origination_code='LHR' travel_agency_code='121212' travel_agency_name='Example.com'>

<flight index='1' flight_number='AG007' destination_code='CIA'/>

<flight index='2' flight_number='JB007' destination_code='BCN'/>

</flights>

</order>

Flights element represents common airlines information for the whole travel like passenger name or travel agency. Each flight element represents a separate flight. Since flights order matters it is recommended to additionally control it by adding index attribute to each flight element.

| Element | Attribute | Type | Description |

|---|---|---|---|

| flights | passenger_name | String(20) | The name of the passenger using only latin alphabet |

| origination_code | String(3) | Airport of origination code | |

| departure_date | String(10) | Departure date in DD.MM.YYYY format | |

| travel_agency_code | String(8) | Travel agency code | |

| travel_agency_name | String(25) | Travel agency name using only latin alphabet | |

| computerized_res_system | String(4) | Computerized reservation system code | |

| credit_reason_indicator | String(1) | Credit reason indicator | |

| ticket_change_indicator | String(1) | Ticket change indicator | |

| is_restricted | Boolean | Restricted ticket indicator | |

| flights/flight | index | Numeric | Sequence number of a flight |

| number | String(5) | Flight number | |

| carrier_code | String(2) | Carrier code | |

| destination_code | String(3) | Airport of destination code | |

| service_class_code | String(1) | Service class code | |

| fare_basis_code | String(6) | Fare basis code | |

| stop_over_code | String(1) | Stop over code |

Recurring

You can begin recurring by sending usual Order with the attribute “recurring_begin” having value “true” in it and then repeat payments from the same card without asking the cardholder to enter card details again. To do this you need to get the value of “recurring_id” attribute from the Payment Result XML. When you continue recurring with “recurring_id” Payment Page is not displayed because the same card is used as when recurring began. Instead Payment Result XML will be sent in response.

Card Token

Card Token feature is almost the same as Recurring, but the difference is that in this case each payment is made with Cardholder present and requires CVV2/CVC2 and 3-D Secure if available. You can obtain Card Token by sending usual Order with the attribute “generate_card_token” having value “true” in it. The generated Card Token is sent only in a Callback and only if payment was successful. Each time token is requested, the new one is generated even for the same card. To use Card Token you can send it in “card_token” attribute, so customer will not have to enter card details again, only CVV2/CVC2 and pass 3-D Secure if needed. Card Token cannot be used more than 1 year after token was generated.

Response

After Payment is completed, the Customer is redirected to Return URL.

Callback

See section Callbacks.

Gateway Mode

Overview

In Gateway Mode the Customer enters credit card data on the Merchant’s website and order is sent from Merchant to CardPay server-to-server. In this case the Merchant has to collect cardholder data on his website that must be PCI DSS certified for that and then send it as a POST request to the CardPay Payment Endpoint.

In response to Merchant’s request, CardPay server sends URL the Customer should be redirected to. When payment is complete, customer will be redirected back to the shop to one of the predefined URLs. Additionally, callbacks and/or email notifications will be sent.

CardPay API Endpoint

- Test URL:

POST: https://sandbox.cardpay.com/MI/cardpayment.html - Live URL:

POST: https://cardpay.com/MI/cardpayment.html

In this mode POST method must be used, all data must be sent in a request’s body.

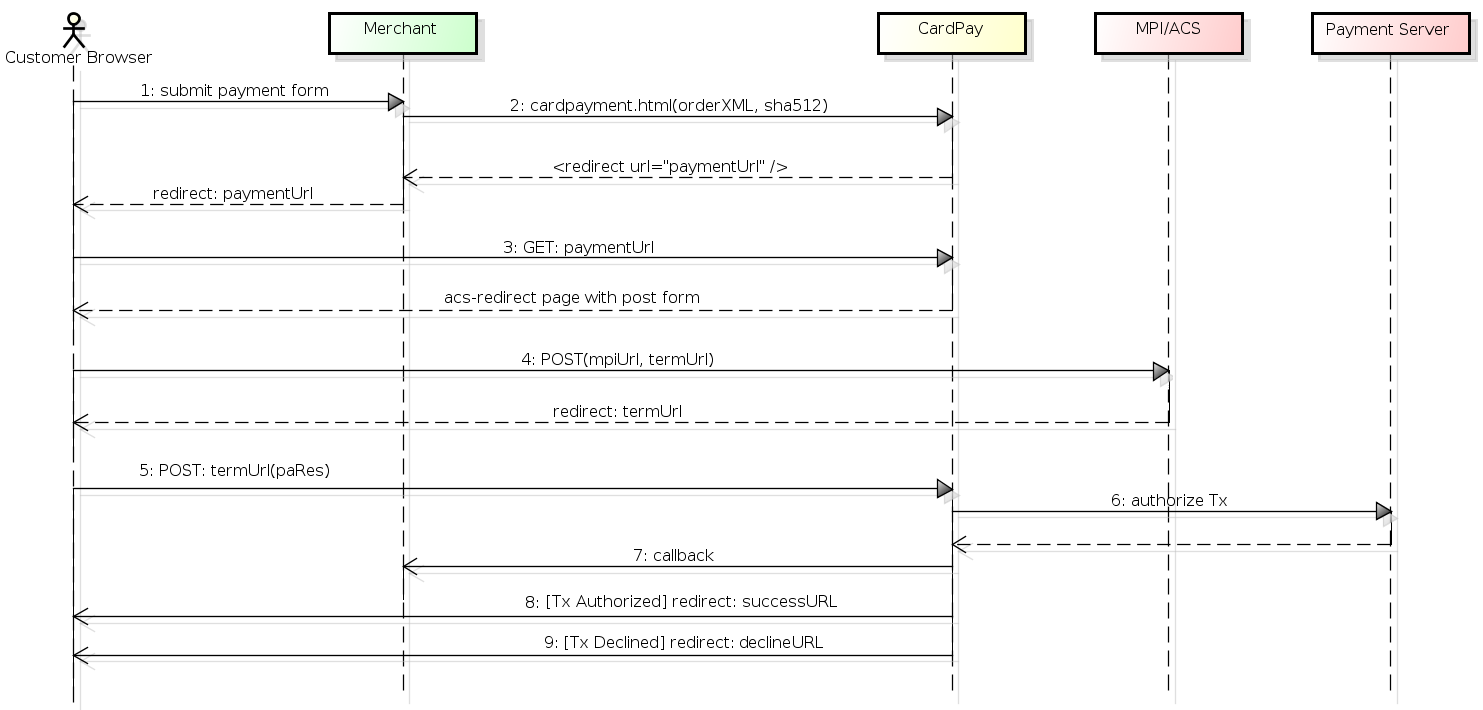

Workflow

- Merchant shows a payment page to the customer. Customer fills card details on the payment page and submits the form.

- Merchant constructs a payment request (orderXML) with information provided by the customer and sends it to the CardPay payment endpoint. CardPay sends an XML response with the redirect URL to the Merchant:

<redirect url="redirectUrl"/> - Merchant redirects the customer to the provided URL for card authorization.

- CardPay shows redirection page to the Customer. Customer interacts with the Issuing Bank’s Access Control Server. On this page they may be asked for 3-D Secure password.

- After that Customer is redirected back to CardPay server with the authentication result (PaRes).

- Upon authentication completion, payment is processed.

- Callback message with the transaction status is sent to callback URL, provided by Merchant. Callback URL is set in Merchant account.

- After that Customer is redirected back to the Merchant’s site. Depending on the authorization result the Customer is redirected to:

Success URL(8) - if transaction was successful. If not specified, the Customer is redirected to the Merchant’s website home URL.Decline URL(9) - if transaction has failed. If not specified, the Customer is redirected to the Merchant’s website home URL.

Request parameters

PHP code example

<?php

$ch = curl_init("payment-page-URL");

$params = array();

$params['orderXML'] = $orderXML; // base64-encoded order XML value

$params['sha512'] = $sha512;

curl_setopt($ch, CURLOPT_RETURNTRANSFER, 1);

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, http_build_query($params));

curl_setopt($ch, CURLOPT_FAILONERROR, 1);

$response = curl_exec($ch);

curl_close($ch);

This is server-to-server request. There are only 2 parameters of request: orderXML and sha512.

orderXML- Base-64 encoded XML Requestsha512- see Calculating Digest section

XML Request

XML Request example using only the minimum required parameters

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="291.86" email="[email protected]">

<card num="4000000000000002" holder="MR CARDHOLDER" cvv="123" expires="02/2020"/>

</order>

Elements and attributes are case-insensitive. Single quotes may be used instead of double quotes.

Elements in bold are mandatory. Attributes in bold are mandatory only if Element is present, default value is shown after equals sign.

Elements in bold and italic are conditional, follow the links for details.

Following data types are used:

String(XX)- any Unicode characters, some validation may be applied though. XX is supported length in Unicode characters, data is truncated if exceeded.Integer- only decimal digits.Decimal- decimal digits with dot as a decimal separator.Boolean- boolean flag: “true” / “false”.

Order Element Structure

| Element | Attribute | Type | Description |

|---|---|---|---|

| order | wallet_id | Integer | Unique merchant’s ID used by the CardPay payment system |

| number | String(50) | Order ID used by the merchant’s shopping cart | |

| description | String(200) | Description of product/service being sold and ID of customer | |

| currency | String(3) | ISO 4217 currency code | |

| amount | Decimal | The total order amount in selected currency with dot as a decimal separator, must be less than 100 millions | |

| String(256) | Customer’s e-mail address | ||

| customer_id | String(256) | Customer’s ID in the merchant’s system | |

| is_two_phase=false | Boolean | If set to “true”, the amount will not be captured but only blocked. | |

| recurring_begin=false | Boolean | If set to “true”, the payment can be repeated later using recurring_id from response. See section Recurring | |

| recurring_id | String(32) | Repeating payment sent before. See section Recurring | |

| generate_card_token=false | Boolean | If set to “true”, a Card Token will be generated and returned in the response or in the notification XMLs | |

| card_token | String(36) | Card Token used instead of card information | |

| authentication_request=false | Boolean | If set to “true”, amount must not be present in request, no payment will be made, only cardholder authentication will be performed. Also can be used to generate Card Token. | |

| dynamic_descriptor | String(25) | Short description of the service or product, must be enabled by CardPay manager to be used | |

| trans_type | String(2) | Identifies the type of transaction being authenticated. Values accepted: 01 = Goods/Service Purchase, 03 = Check Acceptance, 10 = Account Funding, 11 = Quasi-Cash Transaction, 28 = Prepaid Activation and Load. Note: Values derived from the 8583 ISO Standard. | |

| phone | String(8-18) | Customer phone number. Recommended to send phone number in following format “+1 111111111” with country code and subscriber sections (only digits are accepted) of the number, “+” as prefix and “space” as delimiter. Refer to ITU-E.164 for additional information on format and length. | |

| work_phone | String(8-18) | The work phone number provided by the Cardholder. Required (if available) unless market or regional mandate restricts sending this information. Format: string (8-18 symbols) country code + Subscriber number. Refer to ITU-E.164 for additional information on format and length. Example: +1 111111111 | |

| home_phone | String(8-18) | The home phone number provided by the Cardholder. Required (if available) unless market or regional mandate restricts sending this information. Format: string (8-18 symbols) country code + Subscriber number. Refer to ITU-E.164 for additional information on format and length. Example: +1 111111111 | |

| note | String(100) | Note about the order that will not be displayed to customer | |

| return_url | String | Overrides default success URL and decline URL. See section Return URLs | |

| success_url | String | Overrides default success URL only. See section Return URLs | |

| decline_url | String | Overrides default decline_URL only. See section Return URLs | |

| order/card | card element | Represents a payment card. See card element structure below | |

| order/billing | billing element | Represents an address associated with the card. See billing element structure below | |

| order/shipping | shipping element | Represents an address where the order will be delivered to. See shipping element structure below | |

| order/items | List of item elements | List of order positions (items in the shopping cart). See item element structure below | |

| order/flights | List of flight elements | List of flights and passenger information for airlines. See flight element structure below |

Card Element Structure

Example of XML Request with Card element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<card num="4000000000000002" holder="MR CARDHOLDER" cvv="123" expires="02/2020"/>

</order>

| Element | Attribute | Type | Description |

|---|---|---|---|

| card | num | Integer(13-19) | Customer’s card number (PAN). Any valid card number, may contain spaces. Required if ‘card_token’ is not present, see Card Token |

| holder | String(50) | Customer’s cardholder name. Any valid cardholder name. Required if 'card_token’ is not present, see Card Token | |

| expires | String(7) | Customer’s card expiration date. Format: mm/yyyy. Required if 'card_token’ is not present, see Card Token |

|

| cvv | Integer(3) | Customer’s CVV2 / CVC2 | |

| acct_type | String(2) | Indicates the type of account. For example, for a multi-account card product. Required if 3DS Requestor is asking Cardholder which Account Type they are using before making the purchase. Required in some markets (for example, for Merchants in Brazil). Values accepted: 01 = Not Applicable, 02 = Credit, 03 = Debit |

Billing Element Structure

Example of XML Request with Billing element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<card num="4000000000000002" holder="MR CARDHOLDER" cvv="123" expires="02/2020"/>

<billing country="USA" state="NY" zip="10001" city="New York" addr_line_1="450 W." addr_line_2="33 Street" phone="+1 111111111"/>

</order>

BILLING is the customer’s billing address. Depending on account settings Billing may be required. Element structure is identical to shipping address element.

| Element | Attribute | Type | Description |

|---|---|---|---|

| billing | country | String(3) | ISO 3166-1 code of billing country: 2 or 3 latin letters or numeric code |

| state | String(20) | Billing state or province. May include whitespaces, hyphens, apostrophes, commas and dots | |

| zip | String(12) | Billing postal code | |

| city | String(20) | Billing city. May include whitespaces, hyphens, apostrophes, commas and dots | |

| street | String(2-100) | (Deprecated. Replaced by addr_line_1, addr_line_2). Billing street address. May include whitespaces, hyphens, apostrophes, commas, quotes, dots, slashes and semicolons | |

| addr_line_1 | String(0-50) | First line of the street address or equivalent local portion of the Cardholder billing address associated with the card used for this purchase. Should include street and house number. Required (if available) unless market or regional mandate restricts sending this information. May include whitespaces, hyphens, apostrophes, commas, quotes, dots, slashes and semicolons. | |

| addr_line_2 | String(0-50) | Second line of the street address or equivalent local portion of the Cardholder billing address associated with the card used for this purchase. Required (if available) unless market or regional mandate restricts sending this information. |

Shipping Element Structure

Example of XML Request with Shipping element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<card num="4000000000000002" holder="MR CARDHOLDER" cvv="123" expires="02/2020"/>

<shipping country="USA" state="NY" zip="10001" city="New York" addr_line_1="450 W." addr_line_2="33 Street" phone="+1 111111111"/>

</order>

SHIPPING is the address where the order will be delivered. It is used in Anti-fraud System and also can be seen in Payment Manager. But it may be omitted and all the fields of it except country may be omitted too. Element structure is identical to billing address element.

| Element | Attribute | Type | Description |

|---|---|---|---|

| shipping | country | String(3) | ISO 3166-1 code of delivery country: 2 or 3 latin letters or numeric code |

| state | String(20) | Delivery state or province. May include whitespaces, hyphens, apostrophes, commas and dots | |

| zip | String(12) | Delivery postal code | |

| city | String(20) | Delivery city. May include whitespaces, hyphens, apostrophes, commas and dots | |

| street | String(2-100) | (Deprecated. Replaced by addr_line_1, addr_line_2). Delivery street address. May include whitespaces, hyphens, apostrophes, commas, quotes, dots, slashes and semicolons | |

| phone | String(5-20) | Valid customer phone number | |

| addr_line_1 | String(0-50) | First line of the street address or equivalent local portion of the Cardholder shipping address associated with the card used for this purchase. Can include street and house number | |

| addr_line_2 | String(0-50) | Second line of the street address or equivalent local portion of the Cardholder shipping address associated with the card used for this purchase. |

Item Element Structure

Example of XML Request with Items element:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="270" email="[email protected]">

<card num="4000000000000002" holder="MR CARDHOLDER" cvv="123" expires="02/2020"/>

<items>

<item name="T-Shirt" description="Funniest print you ever saw" count="1" price="30"/>

<item name="T-Shirt" description="Coolest print you ever saw" count="4" price="60"/>

</items>

</order>

Item element represents individual item or service.

| Element | Attribute | Type | Description |

|---|---|---|---|

| item | name | String(50) | The name of product / service, provided to the customer |

| description | String(200) | The description of product / service, provided to the customer | |

| count | Numeric | The count of product / service, provided to the customer. Any positive number | |

| price | Decimal | Price of product / service with dot as a decimal separator, must be less than 100 millions |

Flights Element Structure

Example of XML Request with Flights element:

<order wallet_id="21" number="458210" description="Flight from London to Barcelona with transfer in Rome" currency="USD" amount="270" email="[email protected]">

<flights passenger_name='JAMES BOND' departure_date='31.12.2018' origination_code='LHR' travel_agency_code='121212' travel_agency_name='Example.com'>

<flight index='1' flight_number='AG007' destination_code='CIA'/>

<flight index='2' flight_number='JB007' destination_code='BCN'/>

</flights>

</order>

Flights element represents common airlines information for the whole travel like passenger name or travel agency. Each flight element represents a separate flight. Since flights order matters it is recommended to additionally control it by adding index attribute to each flight element.

| Element | Attribute | Type | Description |

|---|---|---|---|

| flights | passenger_name | String(20) | The name of the passenger using only latin alphabet |

| origination_code | String(3) | Airport of origination code | |

| departure_date | String(10) | Departure date in DD.MM.YYYY format | |

| travel_agency_code | String(8) | Travel agency code | |

| travel_agency_name | String(25) | Travel agency name using only latin alphabet | |

| computerized_res_system | String(4) | Computerized reservation system code | |

| credit_reason_indicator | String(1) | Credit reason indicator | |

| ticket_change_indicator | String(1) | Ticket change indicator | |

| is_restricted | Boolean | Restricted ticket indicator | |

| flights/flight | index | Numeric | Sequence number of a flight |

| number | String(5) | Flight number | |

| carrier_code | String(2) | Carrier code | |

| destination_code | String(3) | Airport of destination code | |

| service_class_code | String(1) | Service class code | |

| fare_basis_code | String(6) | Fare basis code | |

| stop_over_code | String(1) | Stop over code |

Recurring

You can begin recurring by sending usual Order with the attribute “recurring_begin” having value “yes” in it and then repeat payments from the same card without asking the cardholder to enter card details again. To do this you need to get the value of “recurring_id” attribute from the Payment Result XML. When you continue recurring with “recurring_id” you can omit “order/card” tag in orderXML because the same card is used as when recurring began. Also instead of redirect XML for recurring continue Payment Result XML will be sent in response.

Card Token

Card Token feature is almost the same as Recurring, but the difference is that in this case each payment is made with Cardholder present and requires CVV2/CVC2 and 3-D Secure if available. You can obtain Card Token by sending usual Order with the attribute “generate_card_token” having value “true” in it. The generated Card Token is sent only in a Callback and only if payment was successful. Each time token is requested, the new one is generated even for the same card. To use Card Token you can send it in “card_token” attribute, in this case “order/card” tag must contain only “cvv” field. Card Token cannot be used more than 1 year after token was generated.

HTTP Response

Example of XML Response:

<?xml version="1.0" encoding="utf"?><redirect url="https://cardpay.com/MI/payments/redirect?token=abc12345"/>

In Gateway Mode the Merchant may receive either the result of payment or XML response containing URL a Customer should be redirected to. Customer may open this URL via either GET or POST method.

The response is in XML format containing one redirect tag with one url attribute:

<?xml version="1.0" encoding="utf"?><redirect url="some_url_value"/>

After Payment is completed, Customer is redirected to Return URL.

Callback

See section Callbacks.

Calculating Digest

<?php

$order = '<order wallet_id="21" number="458210" description="Best ever seen T-Shirt" currency="USD" amount="291.86" email="[email protected]"/>';

$secretKey = 'se1cr2et3w0r4d';

$orderXML = base64_encode($order);

$sha512 = hash('sha512', $order . $secretKey);

String order = "<order wallet_id=\"21\" number=\"458210\" description=\"Best ever seen T-Shirt\" currency=\"USD\" amount=\"291.86\" email=\"[email protected]\"/>";

String secretKey = "se1cr2et3w0r4d";

java.security.MessageDigest digest = java.security.MessageDigest.getInstance("SHA-512");

digest.update((order + secretKey).getBytes(StandardCharsets.UTF_8));

String orderXML = java.util.Base64.getEncoder().encodeToString(order.getBytes(StandardCharsets.UTF_8));

String sha512 = org.apache.commons.codec.binary.Hex.encodeHexString(digest.digest());

Digest is used for authentication and protecting the message from changes. It is calculated from the order XML and the Secret Word you received with your Wallet ID.

For example if you have following access parameters:

- Wallet ID = 21

- Secret Word = se1cr2et3w0r4d

And you are sending the following order:

<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="291.86" email="[email protected]"/>

Then you’ll need to calculate SHA-512 digest of the following string:

"<order wallet_id="21" number="458210" description="Best ever seen T-Shirts" currency="USD" amount="291.86" email="[email protected]"/>se1cr2et3w0r4d"

That will result in the following:

8877da7b52eea2266d9b4f2c7dd4630dd3ea6d1e066a3f2f0921b5163196095a3a7028ba5cf80671471f313719325de1c694f3a9927eaa7cc6370e6ddbe82d3d

And these will be the parameters to be sent to API:

- orderXML =

PG9yZGVyIHdhbGxldF9pZD0iMjEiIG51bWJlcj0iNDU4MjEwIiBkZXNjcmlwdGlvbj0iQmVzdCBldmVyIHNlZW4gVC1TaGlydHMiIGN1cnJlbmN5PSJVU0QiIGFtb3VudD0iMjkxLjg2IiBlbWFpbD0iY3VzdG9tZXJAZXhhbXBsZS5jb20iLz4= - sha512 =

8877da7b52eea2266d9b4f2c7dd4630dd3ea6d1e066a3f2f0921b5163196095a3a7028ba5cf80671471f313719325de1c694f3a9927eaa7cc6370e6ddbe82d3d

Return URLs

Example

The

{...}placeholders will be replaced with real values specific for particular Order.

https://example.com/result?n={number}&s={status}&l={locale}&w={wallet_id}&t={note}

Return URLs are the URLs where customer returns by pressing “Back to the shop” or “Cancel” button in Payment Page mode and redirected automatically in Gateway mode.

URL Selection

There can be 4 different URLs:

- Success URL: where Customer returns after successful transaction

- Decline URL: where Customer returns after failed transaction

- Cancel URL: where Customer returns when no transaction was made (only in Payment Page mode)

- InProcess URL: where Customer returns when transaction was started but not yet completed

By default they all point to the Shop’s home page. The default URLs can be changed only by CardPay manager, but they can be sent with each request (see Order element attributes).

URL Placeholders

URLs may contain some of the following placeholders to be replaced with actual values:

| Placeholder | Description |

|---|---|

| {id} | will be replaced by CardPay’s order ID |

| {number} | will be replaced by Shop’s order number |

| {status} | one of these: approved, pending or declined |

| {locale} | locale received with order if any, otherwise default one |

| {wallet_id} | wallet_id received with order |

| {customer_id} | parameter customer_id provided by the Merchant in XML request |

| {note} | parameter note provided by the Merchant in XML request |

| {order_type} | parameter order_type indicates the type of transaction for a which a callback is generated. ! used only for Callback URLs, not for Return URLs. |

If placeholder is in upper case, value will be sent in upper case, except for note.

Note, that all values are URLEncoded to be compatible with HTTP specifications.

Payment Result XML

Example:

<order id="299150" number="458210" status="APPROVED" description="CONFIRMED" date="15.01.2015 10:30:45" is_3d="true" approval_code="DK3H25" amount="21.12" currency="USD" />

This XML is sent to the Callback URL as HTTP POST parameters orderXML and sha512 constructed in the same way as payment request.

All TAGs and ATTRIBUTE names are sent in lower case.

| Attribute | Example | Description | Condition |

|---|---|---|---|

| id | 299150 | ID assigned to the order in CardPay | Symbol ’-’ is returned when order was cancelled by customer or order was incorrect |

| refund_id | 299151 | ID assigned to the refund in CardPay | Only for refund |

| number | 458210 | Merchant’s ID of the order | If it was received from Merchant |

| status | APPROVED | See possible values below | Always present |

| description | CONFIRMED | CardPay’s message about order’s validation | Always present |

| date | 15.01.2015 10:30:45 | Format DD.MM.YYYY hh:mm:ss. For order: date and time when the order was received. For refund: date and time when the refund was received. | Always present |

| customer_id | 11021 | Customer’s ID in the merchant’s system | Present if was sent with Order |

| card_bin or card_num | 400000 or …0002 or 400000…0002 | Part of card number | Not present by default, ask CardPay manager to enable it if needed, Callback URL must support HTTPS |

| card_holder | John Silver | Name of cardholder | Not present by default, ask CardPay manager to enable it if needed, Callback URL must support HTTPS |

| card_expires | 02/2017 | Card expiration date in MM/YYYY format | Not present by default, ask CardPay manager to enable it if needed, Callback URL must support HTTPS |

| decline_reason | Insufficient funds | Bank’s message about order’s decline reason | When transaction was declined |

| decline_code | 05 | Optional code of the decline | Included only when transaction is declined and sending of decline codes is enabled by wallet settings |

| approval_code | DK3H25 | Authorization code, provided by bank | Only in case of successful transaction |

| is_3d | true | Was 3-D Secure authentication made or not | Always present |

| currency | USD | Transaction currency as received with order | Always present |

| amount | 21.12 | Current transaction’s amount as received with order, but can be reduced by refunds later. In case of refund notification this amount is before the refund was made | Not present for authentication request |

| recurring_id | 19F0B681E6F74F83AA6AB0162D7BF3A5 | ID of recurring that can be used to continue recurring in future | Only for successful recurring begin |

| refunded | 7.04 | Refund amount in order’s currency | In case of refund notification |

| note | VIP customer | Note about the order | Present if was sent with Order |

| ip | IP of customer | IP address of customer | Present if wallet settings has this option enabled. By default the option is not enabled |

| card_token | 067e6162-3b6f-4ae2-a171-2470b63dff00 | Generated Card Token | Present if “generate_card_token” flag was set to “true” in the payment request and the payment was successful |

| [email protected] | Customer’s e-mail address | Not present by default, ask CardPay manager to enable it if needed |

Status Codes

Status field may have one of these values:

| Status | Description |

|---|---|

| APPROVED | Transaction successfully completed, amount was captured |

| DECLINED | Transaction denied |

| PENDING | Transaction successfully authorized, but needs some time to be verified, amount was held and can be captured later |

| VOIDED | Transaction was voided (in case of void notification) |

| REFUNDED | Transaction was refunded (in case of refund notification) |

| CHARGEBACK | Customer’s chargeback claim was received (in case of chargeback notification) |

| CHARGEBACK RESOLVED | Customer’s claim was rejected, same as APPROVED (in case of resolved chargeback notification) |

Decline Codes

| Code | Description |

|---|---|

| 01 | System malfunction |

| 02 | Cancelled by customer |

| 03 | Declined by Antifraud |

| 04 | Declined by 3-D Secure |

| 05 | Only 3-D Secure transactions are allowed |

| 06 | 3-D Secure availability is unknown |

| 07 | Limit reached |

| 10 | Declined by bank (reason not specified) |

| 11 | Common decline by bank |

| 13 | Insufficient funds |

| 14 | Card limit reached |

| 15 | Incorrect card data |

| 16 | Declined by bank’s antifraud |

| 17 | Bank’s malfunction |

| 18 | Connection problem |

Callbacks

Handling Callback

POST /callback HTTP/1.1

HOST: example.com

Query String Parameters:

orderXML: ...

sha512: ...

<?php

if (empty($_REQUEST["orderXML"])) {

Logger::addLog('CardPay callback: orderXML parameter is empty', 4, 1);

exit;

}

if (empty($_REQUEST["sha512"])) {

Logger::addLog('CardPay callback: sha512 parameter is empty', 4, 2);

exit;

}

$cardpaySecretKey = Configuration::get('CARDPAY_SECRET_KEY');

if (empty($cardpaySecretKey)) {

Logger::addLog('CardPay callback: secret key is empty', 4, 3);

exit;

}

$cardpayOrderXML = $_REQUEST["orderXML"];

$cardpaySha512 = $_REQUEST["sha512"];

$orderXML = base64_decode($cardpayOrderXML);

$genSha512 = hash('sha512', $orderXML . $cardpaySecretKey);

// if both hashes are the same, the post should come from CardPay Inc

if ($genSha512 != $cardpaySha512) {

Logger::addLog('CardPay callback: generated SHA512 is not equal to CardPay SHA512', 4, 4, 'generatedSha512', $genSha512);

exit;

}

// get order XML as object

$orderXMLObj = simplexml_load_string($orderXML);

// order XML fields validation

if (empty($orderXMLObj)) {

Logger::addLog('CardPay callback: order XML object is empty', 4, 5);

exit;

}

if (empty($orderXMLObj['number'])) {

Logger::addLog('CardPay callback: cart id is empty', 4, 6);

exit;

}

if (empty($orderXMLObj['status'])) {

Logger::addLog('CardPay callback: order status is empty', 4, 7);

exit;

}

// order must have APPROVED or PENDING status

// if status is DECLINED then do nothing (exit)

$orderStatus = strtoupper((string)$orderXMLObj['status']);

if (('APPROVED' != $orderStatus) && ('PENDING' != $orderStatus)) {

// order is declined

exit;

}

// get cart information

$cartIdStr = (string)$orderXMLObj['number'];

After the transaction is processed, Payment Result XML is sent to callback URL provided by merchant. Callback URL is set in Merchant account.

Callback URL may contain URL Placeholders like Return URLs do, but note that values set to these placeholders are not signed by digest and should not be used for making decisions, only for optimization. To make any changes in order’s status you need to get status, ID and other fields from the orderXML after sha512 digest was validated.

By the security reasons in production environment it is necessary to use HTTPS based callback URL protected by the certificate signed by valid Certificate Authority (CA).

Callbacks are always sent after received order was completed and when it’s status was changed. If it was not delivered, callback will be repeated. Callback is marked as delivered if successful code (200) was received. Also you can print some fixed text into your response (for example: “OK”) and notify CardPay manager about it then callback is marked as delivered only if successful code (200) and expected text were received.

Intervals for repeating callbacks are following:

- up to 5 minutes after 1st attempt

- 10 minutes after 2nd attempt

- 20 minutes after 3rd attempt

- 30 minutes after 4th attempt

- 45 minutes after 5th attempt

- 1 hour after 6th attempt

- 2 hour after 7th attempt

- 3 hours after 8th attempt

- 5 hours after 9th attempt

- 24 hours after 10th attempt (about 37 hours after 1st attempt)

You can also ask your CardPay manager to set e-mail notification about all cases of callback delivery failures or to disable callback repeating.

Payment result can be also sent by email to merchant and/or customer. It may contain any of the following values:

- Amount and currency

- Confirmation number (authorization code)

- Order number

- Order description

Order Services

The Services are needed to use the Payment Manager functions without using web interface. They provide ability to get the list of orders and change their statuses.

Change Order Status

This method allows you to change order status. It allows to Capture 2-phase transactions, Void transactions when it’s possible or Refund part or full amount of order.

Authentication

To use this service you will need Payment Manager user login and SHA-256 HEX encoded digest of your password. This service will affect only orders available for this user to be modified.

Note: It is strongly recommended to store digest of your password. Do not calculate it from your password for each request!

HTTP Request

Example: For example, if user has login

demoand passworddemoand you received following payment result:

<order id="299150" number="98765" status="PENDING" description="AUTHORIZATION SUCCESS" date="23.12.2015 19:05:38" is_3d="true" approval_code="DK3H25" amount="4.20" currency="USD" />

then your request to void payment should look like:

POST /MI/service/order-change-status HTTP/1.1

Host: sandbox.cardpay.com

Query String Parameters:

id: 299150

status_to: void

client_login: demo

client_password: 2a97516c354b68848cdbd8f54a226a0a55b21ed138e207ad6c5cbb9c00aa5aea

Service Endpoint

This service is available on following entry points URL:

- Test URL:

https://sandbox.cardpay.com/MI/service/order-change-status - Live URL:

https://cardpay.com/MI/service/order-change-status

Request attributes must be sent as HTTP request parameters. According to HTTP specification all parameter values must be URLEncoded.

Parameters in bold and italic required only for “refund” and “payout” operations.

| Parameter | Type | Description | Example |

|---|---|---|---|

| client_login | String | User login. It is the same as for Payment Manager | demo |

| client_password | String(64) | SHA-256 HEX-encoded digest generated from the same password used in Payment Manager | 2a97516c35… |

| id | Integer | ID of Order to be changed | 299150 |

| status_to | "capture" or "void" or "refund" or "payout" |

Action to be performed | void |

| amount | Decimal | Amount of refund or payout. May be omitted for refund, all remaining amount is refunded then | 21.12 |

| reason | String | Description for refund or payout | Out of stock |

XML Response

Order status response example:

Content-Type: text/xml;charset=UTF-8

<response is_executed="yes" refund_id="299151">

<order id="299150" status_to="refund" currency="USD" refund_amount="42.38" remaining_amount="132.54" status="APPROVED" />

</response>

Reply comes as XML content in the HTTP Response body.

| Element | Attribute | Type | Description | Example |

|---|---|---|---|---|

| response | is_executed | "yes" or "no" |

Indicates was the request successful or not | yes |

| refund_id | String | ID of created Refund in case of "refund" operation |

299151 | |

| payout_id | String | ID of created Payout in case of "payout" operation |

299151 | |

| details | String | The reason why request was insuccessful | Login Failed | |

| response/order | Order element | Order change status details |

Order Element Structure

| Attribute | Type | Description | Example |

|---|---|---|---|

| id | String | Requested order’s ID | Numeric |

| status_to | "capture" or "void" or "refund" or "payout" |

Requested action | void |

| currency | String(3) | Currency of refunded amount, ISO 4217 currency code | EUR |

| refund_amount | Decimal | Refunded amount in the currency of processing | 21.12 |

| remaining_amount | Decimal | Amount left after refund was made | 0.00 |

| status | String | Status Code of modified or created order | APPROVED |

Note: when status of refund or payout is PENDING it means that it was not processed yet, the final status will be set later and it can be declined.

REST API

The CardPay API uses HTTP verbs and a RESTful endpoint structure. Request and response payloads are formatted as JSON.

API Endpoints

The API is available at the following URLs:

- Test URL:

https://sandbox.cardpay.com/MI/api/v2 - Live URL:

https://cardpay.com/MI/api/v2

Authentication

Authorization header example

GET /MI/api/v2/payments HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

If user has login `demo` and password `demo`, the Base64 encoded string of "demo:demo" is: ZGVtbzpkZW1v

To use this service you will need Payment Manager user login and password. This service will affect only orders available for this user to be seen.

This service uses Basic access authentication. To authenticate you need to add Authorization header to HTTP request:

Authorization: Basic AUTHORIZATION_TOKEN

AUTHORIZATION_TOKEN string is a Base64 encoded credentials string. The credentials string format is: login:password.

JSON document format

The request data is sent in the HTTP Request body having the Content-Type: application/json.

A JSON object MUST be at the root of JSON API request and response containing data. This object defines a document’s “top level”.

A document contain at least one of the following top-level members:

data: the document’s “primary data”errors: an array of error objectsmeta: a meta object that contains non-standard meta-information.

A document MAY contain any of these top-level members:

links: a links object related to the primary data.

The top-level links object MAY contain the following members:

self: the link that generated the current response document.related: a related resource link when the primary data represents a resource relationship. pagination links for the primary data.

The document’s “primary data” is a representation of the resource or collection of resources targeted by a request.

Primary data MUST be either:

- a single resource object, a single resource identifier object, or null, for requests that target single resources

- an array of resource objects, an array of resource identifier objects, or an empty array (

[]), for requests that target resource collections

A logical collection of resources MUST be represented as an array, even if it only contains one item or is empty.

“Resource objects” appear in a JSON API document to represent resources.

A resource object SHOULD contain at least the following top-level members:

- id

- type

Errors

Processing Errors

A server MAY choose to stop processing as soon as a problem is encountered, or it MAY continue processing and encounter multiple problems. For instance, a server might process multiple attributes and then return multiple validation problems in a single response.

When a server encounters multiple problems for a single request, the most generally applicable HTTP error code SHOULD be used in the response.

For instance, 400 Bad Request might be appropriate for multiple 4xx errors or 500 Internal Server Error might be appropriate for multiple 5xx errors.

Error Objects

Error objects provide additional information about problems encountered while performing an operation. Error objects MUST be returned as an array keyed by errors in the top level of a JSON API document.

An error object MAY have the following members:

id: a unique identifier for this particular occurrence of the problem.links: a links object containing the following members:about: a link that leads to further details about this particular occurrence of the problem.

status: the HTTP status code applicable to this problem, expressed as a string value.title: a short, human-readable summary of the problem that SHOULD NOT change from occurrence to occurrence of the problem, except for purposes of localization.detail: a human-readable explanation specific to this occurrence of the problem.source: an object containing references to the source of the error, optionally including any of the following members:pointer: a JSON Pointer [RFC6901] to the associated entity in the request document [e.g. “/data” for a primary data object, or “/data/attributes/title” for a specific attribute].parameter: a string indicating which URI query parameter caused the error.

meta: a meta object containing non-standard meta-information about the error.

Payments

The payments namespace contains resource collections for payments.

This service is available on following entry points URL:

- Test URL:

GET: https://sandbox.cardpay.com/MI/api/v2/payments - Live URL:

GET: https://cardpay.com/MI/api/v2/payments

Note that only GET method is allowed.

Operation

GET /MI/api/v2/payments

Get the list of payments for a period of time. This service will return only payments available for this user to be seen.

Request

Payments request example

GET /MI/api/v2/payments HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Query String Parameters:

startMillis: 1438981200000

endMillis: 1439381873000

walletId: 123

maxCount: 10

See Request Attributes section bellow. These attributes must be sent as HTTP parameters.

Response

Payments response example

{

"data": [

{

"id": "12345",

"number": "order00017",

"state": "DECLINED",

"date": 1438981200400,

"customerId": "11021",

"declineReason": "Insufficient funds",

"declineCode": "13",

"currency": "USD",

"amount": 21.12,

"description": "Special order - REF.ID: 13579",

"note": "VIP customer",

"email": "[email protected]",

"is3d": false,

"rrn": "000012345678",

"maskedPan": "400000...0002",

"issuingCountryCode": "US"

},

{

"id": "12346",

"number": "order00018",

"state": "COMPLETED",

"date": 1505687851000,

"currency": "USD",

"amount": 42.24,

"description": "Special order - REF.ID: 135790",

"note": "Platinum customer",

"email": "[email protected]",

"authCode": "DK3H25",

"is3d": true,

"rrn": "000012345679",

"maskedPan": "400000...0002",

"issuingCountryCode": "US"

}

],

"hasMore": false

}

Reply comes as JSON content in the HTTP Response body.

| Element | Description | Type | Example |

|---|---|---|---|

| data | List of payment elements | See Payment Element Structure | |

| hasMore | Indicates if there are more payments for this period than was returned | Boolean | true |

Operation

Payment info request example

GET /MI/api/v2/payments/12347 HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Payment info response example

{

"data": {

"type": "PAYMENTS",

"id": "12347",

"created": 1522740708000,

"updated": 1522740709206,

"state": "COMPLETED",

"rrn": "000018872018",

"merchantOrderId": "955987",

"description": "Special order - REF.ID: 13579"

}

}

GET /MI/api/v2/payments/:id

Use this call to get the state of the payment by it’s id.

Operation returns a "data" element containing Order Status Object

Refunds

The refunds namespace contains resource collections for refunds.

This service is available on following entry points URL:

- Test URL:

GET: https://sandbox.cardpay.com/MI/api/v2/refunds - Live URL:

GET: https://cardpay.com/MI/api/v2/refunds

Note that only GET method is allowed.

Operation

GET /MI/api/v2/refunds

Get the list of refunds for a period of time. This service will return only refunds available for this user to be seen.

Request

Refunds request example

GET /MI/api/v2/refunds HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Query String Parameters:

startMillis: 1455045922000

endMillis: 1455545922000

walletId: 123

maxCount: 10

See Request Attributes section bellow. These attributes must be sent as HTTP parameters.

Response

Refunds response example

{

"data": [

{

"id": "12348",

"number": "949225",

"state": "COMPLETED",

"date": 1455045922100,

"currency": "EUR",

"amount": 14.14,

"description": "Special order - REF.ID: 13579",

"email": "[email protected]",

"authCode": "DK3H25",

"is3d": true,

"originalOrderId": "12350",

"rrn": "12345678",

"maskedPan": "400000...0002",

"issuingCountryCode": "US"

},

{

"id": "12349",

"number": "214250",

"state": "COMPLETED",

"date": 1455045922200,

"currency": "EUR",

"amount": 8.84,

"description": "Special order - REF.ID: 13580",

"email": "[email protected]",

"authCode": "dpsncc",

"is3d": false,

"originalOrderId": "12351",

"rrn": "12345678",

"maskedPan": "400000...0077",

"issuingCountryCode": "US"

}

],

"hasMore": false

}

Reply comes as JSON content in the HTTP Response body.

| Element | Description | Type | Example |

|---|---|---|---|

| data | List of refund elements | See Refund Element Structure | |

| hasMore | Indicates if there are more refunds for this period than was returned | Boolean | true |

Operation

Refund info request example

GET /MI/api/v2/refunds/12352 HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Refund info response example

{

"data": {

"type": "REFUNDS",

"id": "12352",

"created": 1523540268000,

"updated": 1523540269247,

"state": "COMPLETED",

"rrn": "12345679",

"merchantOrderId": "890081",

"description": "Special order - REF.ID: 13581"

}

}

GET /MI/api/v2/refunds/:id

Use this call to get the state of the refund by it’s id.

Operation returns a "data" element containing Order Status Object

Payouts

The payouts namespace contains resource collections for payouts.

This service is available on following entry points URL:

- Test URL:

POST, GET: https://sandbox.cardpay.com/MI/api/v2/payouts - Live URL:

POST, GET: https://cardpay.com/MI/api/v2/payouts

Payout request example:

POST /MI/api/v2/payouts HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Query String Parameters:

walletId: 12345

{

"data": {

"type": "PAYOUTS",

"timestamp": "2015-08-28T09:09:49Z",

"merchantOrderId": "PO01242324",

"amount": 128.97,

"currency": "USD",

"card": {

"number": "4000000000000002",

"expiryMonth": 7,

"expiryYear": 2019

},

"description": "X-mass gift for you, my friend",

"note": "Payout Ref.12345",

"email": "[email protected]"

}

}

Operation:

POST /MI/api/v2/payouts

Create Payout Order.

Request

Properties and elements names are case-sensitive.

Properties and elements in bold are mandatory. Properties in bold are mandatory only if containing element is present.

Properties in bold and italic are conditional, follow the links for details.

Request attribute walletId must be sent as HTTP parameter.

| Parameter | Type | Description | Example |

|---|---|---|---|

| walletId | String | Unique merchant’s ID used by the CardPay payment system | 12345 |

Note that some request fields are not mandatory but still may be required by Bank. Please contact CardPay manager for more info on the requirements.

Request Object

| Property | Type | Description | Example |

|---|---|---|---|

| type | String | always "PAYOUTS" |

PAYOUTS |

| timestamp | String | Represents the date and time in ISO 8601 format when the order was sent to CardPay | 2015-08-28T09:09:49Z |

| merchantOrderId | String(50) | Represents the ID of the order in merchant’s system | PO01242324 |

| amount | Decimal | Represents the amount to be transferred to the customer’s card, must be less than 100 millions | 128.97 |

| currency | String(3) | ISO 4217 currency code of the transaction. Must match wallet currency | USD |

| card | card | Represents a debit or credit card. Required if ‘cardToken’ is not present, see Card Token | |

| cardToken | String(36) | Card Token used instead of card information | 067e6162-3b6f-4ae2-a171-2470b63dff00 |

| billing | billing | Represents the customer’s billing address | |

| description | String(200) | Transaction description | |

| dynamicDescriptor | String(25) | Short description of the service or product, must be enabled by CardPay manager to be used | |

| note | String(50) | Note about the order, not shown to the customer | Payout Ref.12345 |

| recipientInfo | String(500) | Payout recipient information, see Recipient Information | John Smith |

| String(256) | Customer’s e-mail address, see Recipient Information | [email protected] |

Card Object

| Property | Type | Description |

|---|---|---|

| number | int(13-19) | Customer’s card number (PAN). Any valid card number, may contain spaces |

| expiryMonth | int(2) | Customer’s card expiration month in format: mm, contact CardPay manager, this field may be required by Bank |

| expiryYear | int(4) | Customer’s card expiration year in format: yyyy, contact CardPay manager, this field may be required by Bank |

Both expiryMonth and expiryYear must be present or absent at the same time.

Billing Object

| Property | Type | Description |

|---|---|---|

| country | String(3) | ISO 3166-1 code of delivery country: 2 or 3 latin letters or numeric code |

| state | String(20) | Billing state or province |

| zip | String(12) | Billing postal code |

| city | String(20) | Billing city |

| street | String(2-100) | Billing street address |

| phone | String(5-20) | Customer phone number |

Billing is the customer’s billing address. Billing may be required by Bank, contact CardPay manager for details.

Card Token

Payout request with Card Token example:

POST /MI/api/v2/payouts HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Query String Parameters:

walletId: 12345

{

"data": {

"type": "PAYOUTS",

"timestamp": "2015-08-28T09:09:49Z",

"merchantOrderId": "PO01242324",

"amount": 128.97,

"currency": "USD",

"cardToken": "067e6162-3b6f-4ae2-a171-2470b63dff00",

"description": "X-mass gift for you, my friend",

"note": "Payout Ref.12345",

"email": "[email protected]"

}

}

You can obtain Card Token by sending Payment with the attribute 'generate_card_token’ having value “true” in it. Payout then can be made to the same card used for Payment. To do that you need to send property 'cardToken’ instead of 'card’ and 'recipientInfo’. Either 'cardToken’ or 'card’ property must be present, not both at the same time. Card Token cannot be used more than 1 year after token was generated.

Recipient Information

Property 'recipientInfo’ may be required by Bank. In most cases it’s Cardholder’s name, contact CardPay manager for requirements. It must be omitted when property 'cardToken’ is present. Property 'email’ may also be required by Bank, contact CardPay manager.

Response

Payout response example

{

"data": {

"type": "PAYOUTS",

"id": "12353",

"created": 1523605624890,

"updated": 1523605625142,

"state": "COMPLETED",

"rrn": "000018872019",

"merchantOrderId": "PO01242324",

"description": "Special order - REF.ID: 13579"

},

"links": {

"self": "https://sandbox.cardpay.com/MI/api/v2/payouts/12353"

},

"meta": {

"request": {

"timestamp": 1523610589000,

"type": "PAYOUTS",

"merchantOrderId": "PO01242324",

"amount": 128.97,

"currency": "USD",

"note": "Payout Ref.12345",

"description": "X-mass gift for you, my friend",

"email": "[email protected]",

"card": {

"number": "400000...0002",

"expiryMonth": 7,

"expiryYear": 2019

}

}

}

}

| Property | Description | Type |

|---|---|---|

| data | Contains the payout order details | Order Status Object. Property “type” is always "PAYOUTS". |

| links | Contains the link to payout order | links element structure below |

| meta | May contain extra information, e.g. payout request | object |

The server reply comes as JSON content in the HTTP Response body and HTTP status code 201 Created.

Additionally, server will return the URL of the created payout order in the Location HTTP header and in "links.self" JSON property of the response object.

The "data" property will contain Order Status with the State of the operation.

If the payout operation was successful, the state will be "COMPLETED". If it failed, the state will be "DECLINED".

In case if the payout was accepted, but not performed yet, the state will be "AUTHORIZED". In this case the final result will be sent in a Callback or can be checked a few minutes later using GET method of this API.

The "meta" property may contain additional information, e.g. original request with masked card number.

Links Object

| Element | Attribute | Type | Description |

|---|---|---|---|

| links | self | String | A link to the newly created Payout order |

Operation

GET /MI/api/v2/payouts

Get the list of payouts for a period of time. This service will return only payouts available for this user to be seen.

Request

Payouts request example

GET /MI/api/v2/payouts HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Query String Parameters:

startMillis: 1438980200000

endMillis: 1438981200000

walletId: 123

maxCount: 10

See Request Attributes section bellow. These attributes must be sent as HTTP parameters.

Response

Payouts response example

{

"data": [

{

"id": "2200421",

"number": "ORD437282",

"state": "DECLINED",

"date": 1438980200010,

"declineReason": "Incorrect card data",

"declineCode": "15",

"currency": "EUR",

"amount": 12.34,

"description": "X-mass gift for you, my friend",

"note": "Some note",

"email": "[email protected]",

"is3d": false,

"rrn": "9a28135e-61be-2a97-gac5-54253da2fb2a",

"maskedPan": "400000...0002",

"issuingCountryCode": "US"

},

{

"id": "2200422",

"number": "ORD437283",

"state": "COMPLETED",

"date": 1438980200020,

"currency": "EUR",

"amount": 56.78,

"description": "Special order - REF.ID: 13579",

"note": "Some note 2",

"email": "[email protected]",

"authCode": "dpsncc",

"is3d": false,

"rrn": "9a28135e-21be-2397-4ac5-55256d72abea",

"maskedPan": "400000...0002",

"issuingCountryCode": "US"

}

],

"hasMore": false

}

Reply comes as JSON content in the HTTP Response body.

| Element | Description | Type | Example |

|---|---|---|---|

| data | List of payout elements | See Payout Element Structure | |

| hasMore | Indicates if there are more payouts for this period than was returned | Boolean | true |

Operation

Payout info request example

GET /MI/api/v2/payouts/12354 HTTP/1.1

Host: sandbox.cardpay.com:443

Content-Type: application/json

Authorization: Basic ZGVtbzpkZW1v

Payout info response example

{

"data": {

"type": "PAYOUTS",

"id": "12354",

"created": 1523605624000,

"updated": 1523605625142,

"state": "COMPLETED",

"rrn": "000018872019",

"merchantOrderId": "PO01242324",

"description": "Special order - REF.ID: 13579"

}

}

GET /MI/api/v2/payouts/:id

Use this call to get the status of the specified payout by it’s id.

Operation returns a "data" element containing Order Status Object

Common Objects

Order Report Request Attributes

| Parameter | Type | Description | Example |

|---|---|---|---|

| startMillis | Long | Epoch time in milliseconds when requested period starts (inclusive), default is 24 hours before endMillis |

1438336800000 |

| endMillis | Long | Epoch time in milliseconds when requested period ends (not inclusive), must be less than 7 days after startMillis, default is current time |

1438941600000 |

| number | String | Get list of orders by Order Number | order00017 |

| walletId | Integer | Limit result with single WebSite orders | 101 |

| maxCount | Integer | Limit number of returned orders, must be less than 10,000, default is 1,000 | 100 |

Order Report Response Object

| Attribute | Description | Type | Example |

|---|---|---|---|

| id | ID assigned to the order in CardPay | String | 299150 |

| number | Merchant’s ID of the order | String | order00017 |

| state | Order State | String | COMPLETED |

| date | Epoch time when this order started | Long | 1438336812000 |

| customerId | Customer’s ID in the merchant’s system | String | 11021 |

| declineReason | Bank’s message about order’s decline reason | String | Cancelled by customer |

| declineCode | Code of the decline | String | 02 |

| currency | Transaction currency | String(3) | USD |

| amount | Initial order amount | Decimal | 21.12 |

| description | Order description. In case of refunds it contains refund reason | String | Special order - ID: 13579 |

| note | Note about the order | String | VIP customer |

| Customer’s e-mail address | String | [email protected] | |

| authCode | Authorization code, provided by bank | String | DK3H25 |

| is3d | Was 3-D Secure authentication made or not | Boolean | true |

| refundedAmount | Only for payments: refund amount in order’s currency | Decimal | 7.04 |

| originalOrderId | Only for refunds: CardPay ID of original payment order | String | 299151 |

| rrn | RRN (Retrieval Reference Number), supplied by the acquiring financial institution | String | 000012345678 |

| maskedPan | Masked PAN (shows first 6 digits and 4 last digits) | String | 400000…0002 |

| issuingCountryCode | Country code of issuing country | String | US |

Order Status Object

Successful Order state example

{

"type": "PAYMENTS",

"id": "12355",

"created": 1522738766000,

"updated": 1522740001760,

"state": "COMPLETED",

"rrn": "000018872018",

"merchantOrderId": "1",

"description": "Special order - REF.ID: 13579"

}

Failed Order state example

{

"type": "PAYMENTS",

"id": "12356",

"created": 1523333446000,

"updated": 1523333469383,

"state": "DECLINED",

"decline": {

"code": "10",

"description": "Declined by bank (not classified)"

},

"merchantOrderId": "848868"

}

| Property | Type | Description |

|---|---|---|

| type | String | Order type |

| id | String | ID of the newly created Payment order in CardPay system |

| created | String | Payment order creation date, timestamp |

| updated | String | Payment order last update date, timestamp |

| state | Order State | Payment order state in CardPay system. |

| decline | Object | If order processing was not successful, the reason of decline will be provided |

decline.code |

String | CardPay decline code |

decline.description |

String | Description of the CardPay decline code |

| rrn | String(40) | This value will be set to the Retrieval Reference Number (RRN) supplied by the acquiring financial institution. This number can be provided to the cardholder as a receipt reference number for a successful transaction. |

| merchantOrderId | String(50) | Represents the ID of the order in merchant’s system |

| description | String | Order description. In case of refunds it contains refund reason |

Decline code and description will be present only when processing was not successful.

Order States

State field of the order may have one of the following values:

| State | Description |

|---|---|

| NEW | Order was submitted successfully to CardPay system and transaction was created in CardPay system |

| IN_PROGRESS | Transaction is being processed |

| AUTHORIZED | Transaction was successfully authorized but needs some time to be verified, amount was held and can be captured later |

| DECLINED | Transaction was rejected |

| COMPLETED | Transaction was successfully completed, amount was captured (for payments) |

| CANCELLED | Transaction was cancelled by customer |

| REFUNDED | Transaction was fully refunded |

| VOIDED | Transaction was voided |

| CHARGED_BACK | Customer’s chargeback claim was received |

| CHARGEBACK_RESOLVED | Customer’s chargeback claim was rejected, equals to COMPLETED |

Changelog

2019-08-14 - 2.70

- 3-D Secure 2 API changes added

2018-04-18 - 2.61

- Added

Flightstag for airlines - Email and card expiration date now can be returned in a Callback

2018-03-14 - 2.60

- Unused decline code 12 was removed

- Card Token expiration condition changed

2017-03-16 - 2.59

- “Dynamic descriptor” parameter was added

2016-12-05 - 2.57